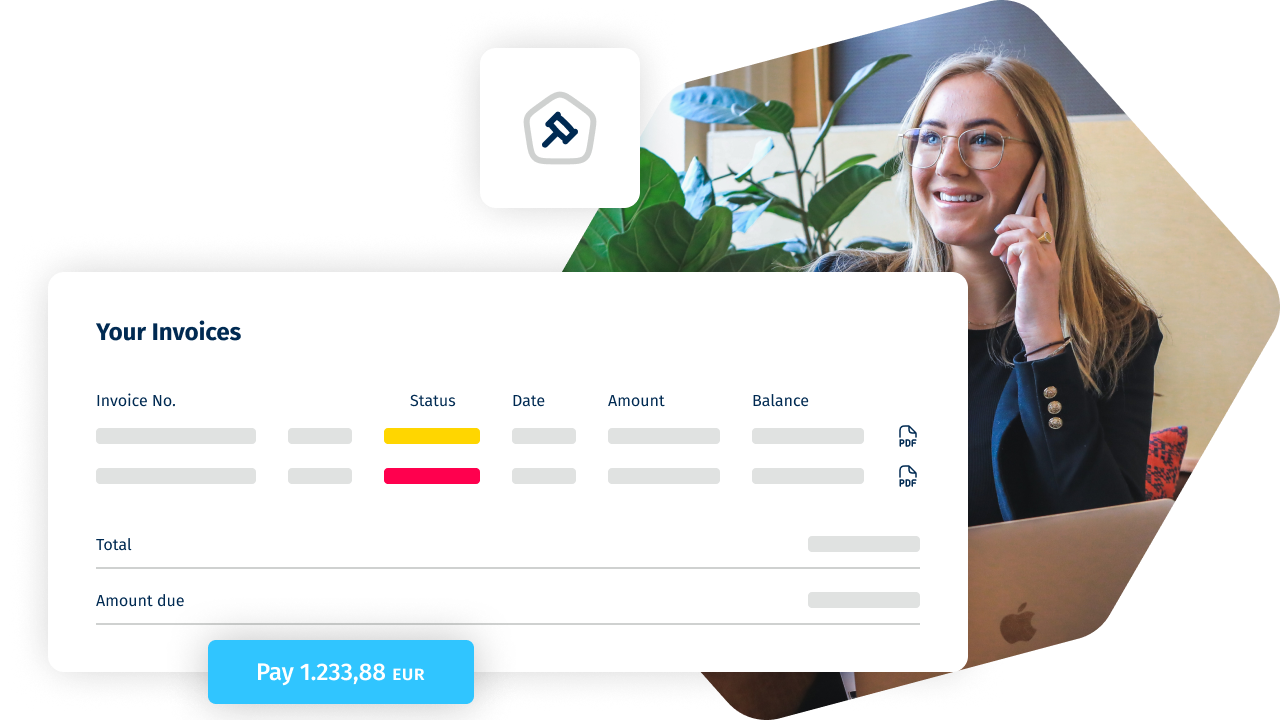

Create your debt recovery file in just a few clicks

With Clearnox, creating a debt recovery file is simple. Select the unpaid invoice(s) directly in the interface and create and send a downloadable file in a few clicks. No need to enter the details again. The Clearnox approach is quick, cost effective and secure.