Time-stamped, communications tracking

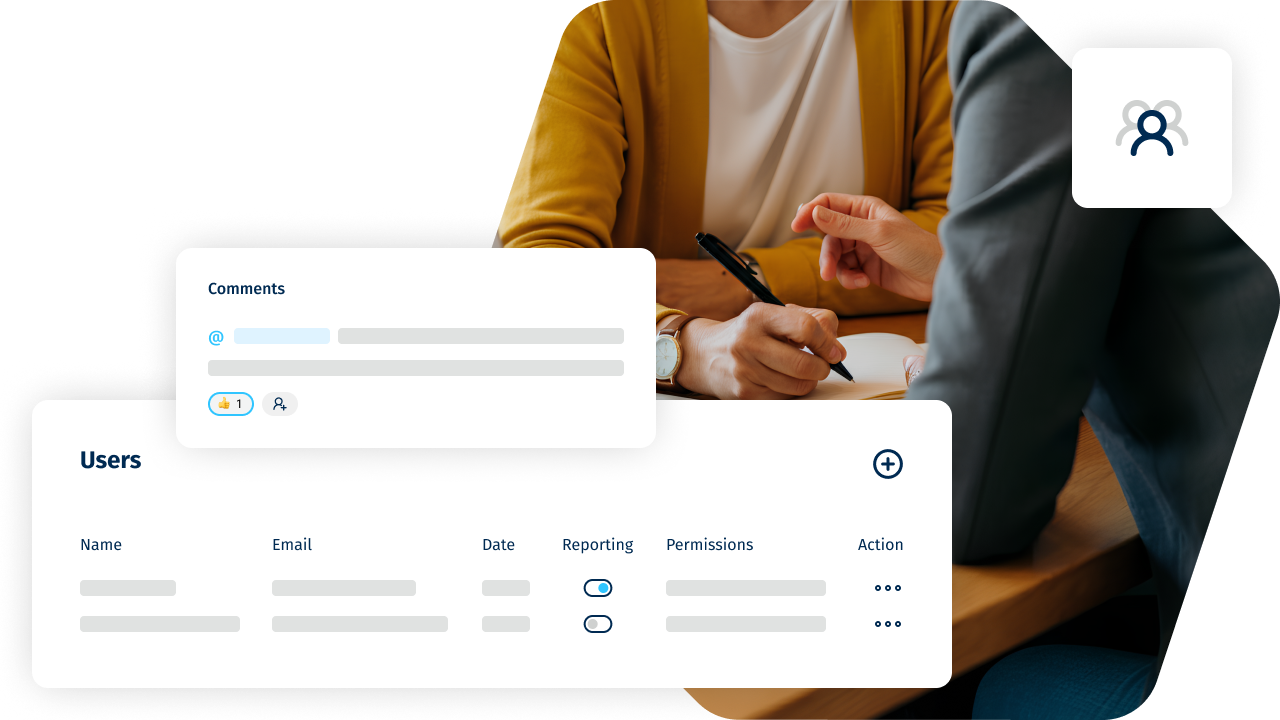

Every internal conversation is time-stamped and organised by date in a comments thread for each client.

You have access to the full details of all actions taken.

Optimising accounts receivable demands more than sending automatic payment reminders.

Collaborative team working is key: accountancy, CFO, sales team, and sales admin. All need to be kept in the loop.

Clearnox can help you achieve this by acting as a central communication tool – bringing you structured tracking in a shared, secure environment.

Every internal conversation is time-stamped and organised by date in a comments thread for each client.

You have access to the full details of all actions taken.

Tag a colleague to notify them or hand over a task directly in the comments thread.

They’ll be notified instantly via email and on the Clearnox interface. It’s a simple, effective way to get the right people involved without manual, separate communication – save time and ensure every invoice is chased.

Each user receives a custom summary email with the key indicators that are relevant for them. Everyone has a clear, up-to-date overview of the status of each client, current tasks and future priorities in their inbox.

Clearnox adapts to meet your organisation’s needs! Access permissions are defined according to each user role (e.g. administrator, user, viewer). Portfolio management means client accounts can be attributed to one or several staff members, making it easy to share and track tasks.

Cash culture is all the effort that goes into securing and optimising a company’s cash flow. It’s based on the understanding that every service is part of the client cycle, from signing a contract through to invoice payment. Developing a cash culture can help you get paid faster, anticipate late payments and enhance financial stability.

Managing client portfolios isn’t just down to the accounts department. Sales reps, sales administrators and CFOs all have a role to play in ensuring effective credit control. Well-organised cross-team working allows information to be shared in real time and prevents duplication of work, as well facilitating agile reactions to disputes and payment delays.

Clearnox centralises all client and invoicing data in a secure, shared space. Staff members can access the information that’s relevant to their role, making communication seamless as everyone’s in the loop. Alerts and notifications further enhance coordination, so client accounts are managed as a team.

Clearnox’s tags and notifications simplify internal communication. You can tag a colleague directly in a comment to notify them of pending tasks in real-time. Say goodbye to multiple emails and time-consuming meetings and react quickly to payment issues.

Yes, Clearnox keeps a complete record of reminders, comments and actions made by each user in one place. Full visibility over client accounts is useful for both disputes and audits.

Yes, the solution has the option to set up access permissions according to roles. So a CFO can view the entire accounts receivable while the sales team will access information about the clients they manage. This customisation offers increased data privacy while ensuring everyone has the tools they need to do their job effectively.

A demo is worth a thousand words.

Book your free demo now.